Triangular arbitrage involves placing offsetting transactions in three currencies to exploit a market inefficiency for a theoretical risk free trade. In the forex market, which is a very efficient market, there is substantial execution risk for retail traders. However, crypto markets are far less efficient and we can profit from it using triangular arbitrage.

In this post, we’ll learn how to trade the BTCUSD / BTCEUR / EURUSD pair ring with the Triangular Arbitrage EA for Metatrader. At the time of writing, many Metatrader brokers offer crypto currencies. The case is clear for applying tri arb to cryptos. BTCUSD and BTCEUR are very volatile crypto currency pairs that fluctuate against each other seven days a week, 24 hours a day, whereas EURUSD is a forex currency pair that trades only from monday-friday. This means that we’ll likely have plenty of triangular arbitrage opportunities during the week and a eat-all-you-want buffet during weekends, when the forex market is closed. The EURUSD price does not change during weekends, meaning any discrepancy between the BTCUSD and BTCEUR is very likely to happen and resolve itself before the EURUSD market opens on Sunday night.

Let’s get started.

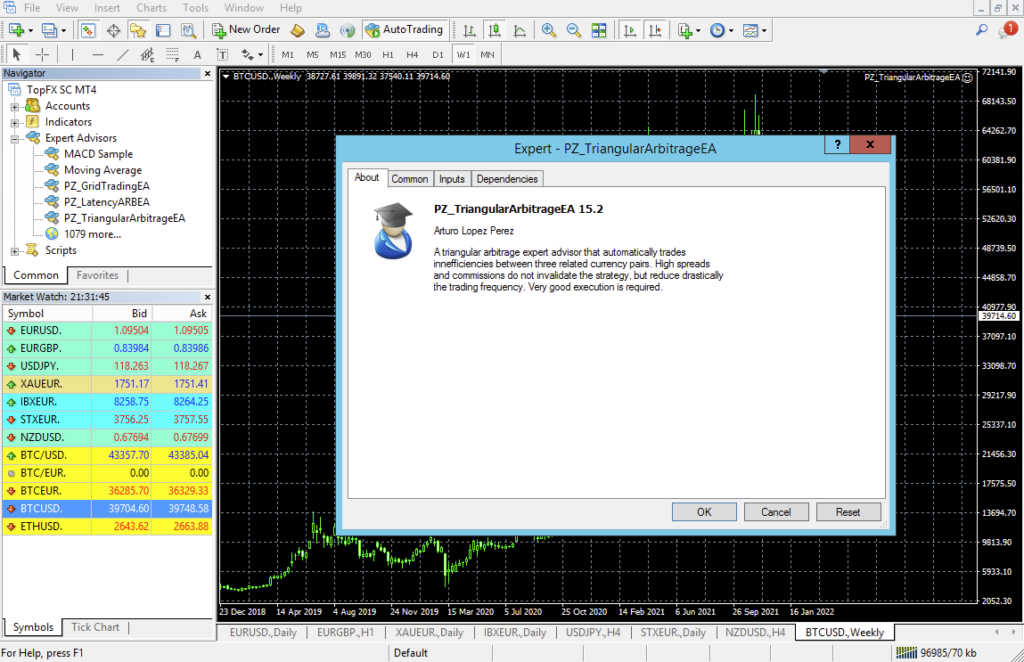

1) Load the EA to the BTCUSD Chart

Just to be clear, the EA could have been loaded into any other chart and not just BTCUSD. But since we are trading BTCUSD primarily, it makes sense to load the EA in this instrument.

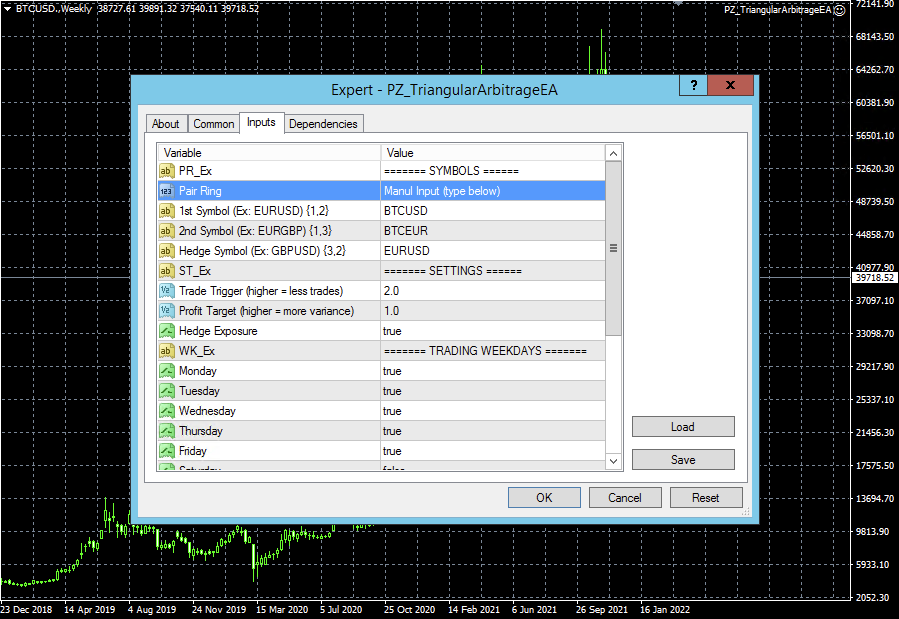

2) Configure the EA

The pair ring we want to trade is not built-in into the EA and we need to configure it using custom symbol names. To do it, follow these steps:

1) Click on the Inputs Tab to edit the EA input parameters.

2) Set Pair Ring as “Manual Input”

3) Set 1st Symbol as “BTCUSD”

4) Set 2nd Symbol as “BTCEUR”

5) Set Hedge Symbol as “EURUSD”

Finally, click on “OK” to load the EA to the chart.

3) That’s it!

The EA is loaded and operating on a crypto-currency ring hedged against the EURUSD forex pair. It’ll trade excessive price discrepancies between BTCUSD and BTCUSD, hedging the exposure using EURUSD during the week and unhedged during the weekends.

Conclusion

While the forex market is extremely efficient making triangular arbitrage a game of latency and network points, crypto currencies still offer plenty of opportunities for arbitrageurs, especially during weekends in which the forex market is closed. Some brokers even offer crypto currency crosses like BTCETH, BTCLTC, BTCBCH, BCHLTC and BTCETH, making it a dream market for us.

![]()